Suez: A Different Kind of Crisis

Photo by KHALED DESOUKI/AFP via Getty Images.

Suez, The Canal Company

The Isthmus of Suez, the narrow strip of land connecting the continents of Africa and Asia is, navigationally speaking, a bit of a pain. In order to move from one side to the other a circumnavigation of Africa (around 10,000km) was necessary. Instead, a canal was built which massively reduced travel time and allowed commerce to flourish between Europe and Asia while bypassing the Ottoman stranglehold. Opened in the November of 1869, the Canal was built by the Suez Canal Company also known, somewhat more wordily, as the Compagnie Universelle du Canal Maritime de Suez.

This company, with a majority French shareholding, operated and owned the canal for the first years of its existence until 1875 when Britain bought £4m worth of shares from the Wāli of Egypt, Isma’il Pasha. British intervention increased (as it tended to do…) and after the 1882 Anglo-Egyptian War, Britain gained physical control of the canal. After a few years of power struggle between the French and British (again, no great surprises here), the Great Powers of the day signed a convention in Constantinople to make the canal a neutral zone and guarantee free passage for all maritime traffic. This convention, conveniently named the Convention of Constantinople, was signed in October 1888 and remained in place until the Suez Crisis of 1956.

In 1956, the then President of Egypt, Gamal Abdel Nasser nationalised the canal in response to the withdrawal of British and American support for the construction of the Aswan Dam. In a dam-ned (sorry, couldn’t stop myself) move for the imperial powers, the UK, France, and Israel invaded Egypt following the Protocol of Sèvres signed in that October (1956). After mounting international pressure, including from the USA, the British and French were forced to withdraw. Touted by some as the end of the British Empire and a large factor in the subsequent decolonisation of former British and French colonies, this Suez Crisis was a defining moment in British and global history.

Suez, not so much of a Canal Company.

The company mentioned earlier, the Compagnie Universelle du Canal Maritime de Suez, lost control of the Suez Canal during the 1956 crisis and received the equivalent of £28.3m in French francs from the Egyptian Government as compensation. After forming the Compagnie Financière de Suez in 1959, Suez remained an important financial institution in France, being nationalised in 1982 and then privatized in 1987.

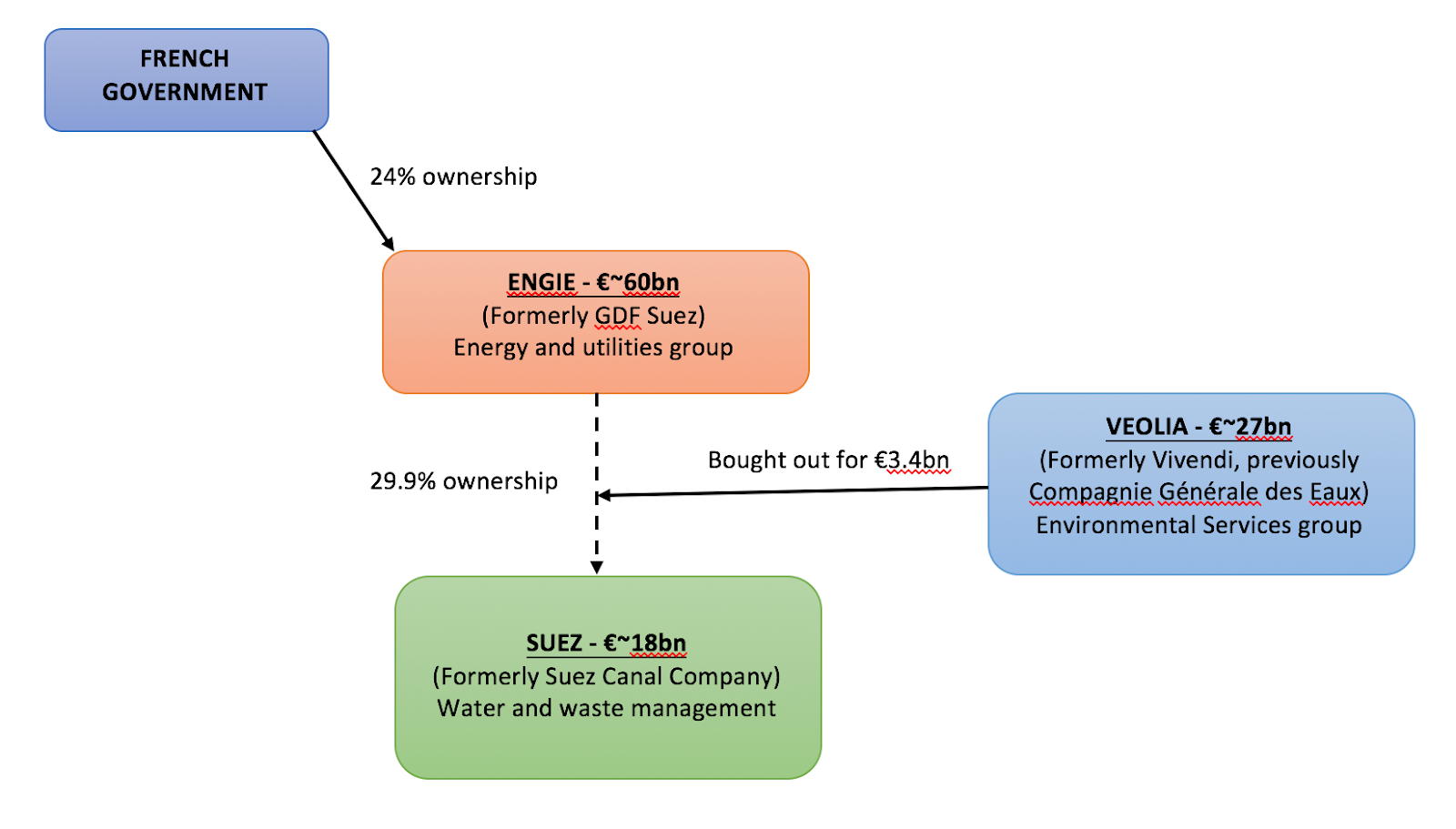

Following a bewildering series of name-changes, mergers, and investments, in 2019 Suez is a colossal waste management and water provider. With a turnover of around €18bn, Suez is the largest private provider of water in the world and a prominent global company with activities across 6 continents (5 if you’re French – they consider the Americas to be one continent).

2020’s Suez Crisis

Cut to October 2020 and Suez is back in the news. The Times speaks of a 2020 “Suez Crisis,” and the French government has had to wade in. Veolia, another French waste and water management supplier has bought 29.9% of Suez for €3.4bn from its largest stakeholder, Engie (formerly GDF Suez). This falls just under the 30% threshold which would require Veolia to attempt a full takeover under French law. One of the terms of this acquisition, after months of tricky negotiation is that the boards of Suez and Veolia must reach an agreement. The French Government, a 22% stakeholder in Engie, voted against the deal to accept Veolia’s terms due to the lack of an agreement between the two boards, although some have suggested that this was mostly public posturing, with the deal receiving President Macron’s assent privately. Competition concerns have also been raised over Veolia developing an unfair monopoly on water management, which it hopes to assuage by selling off Suez’s domestic water assets. Suez have pre-empted this and have placed these assets into a protected entity in order to prevent their sale.

It’s going to be a difficult year for Veolia if they want to push through this deal.

Why should I care?

Commercial disputes between the glass office blocks of the Parisian suburbs may seem insignificant and distant but quite the opposite is true. Suez’s COO, Jean-Marc Boursier has claimed that approximately 10,000 jobs will be lost (they currently employ 5,000 staff in the UK) although Veolia’s chairman fought back contending that no on the ground staff will lose their jobs. With a combined global workforce of ~270,000, the two companies’ merger will have an enormous impact around the world. Even if you think yourself unbothered by business affairs – one to keep an eye on!

Freddie Tidswell is a fourth year student at the University of Edinburgh studying French and Spanish.